Details of the share and distribution to shareholders

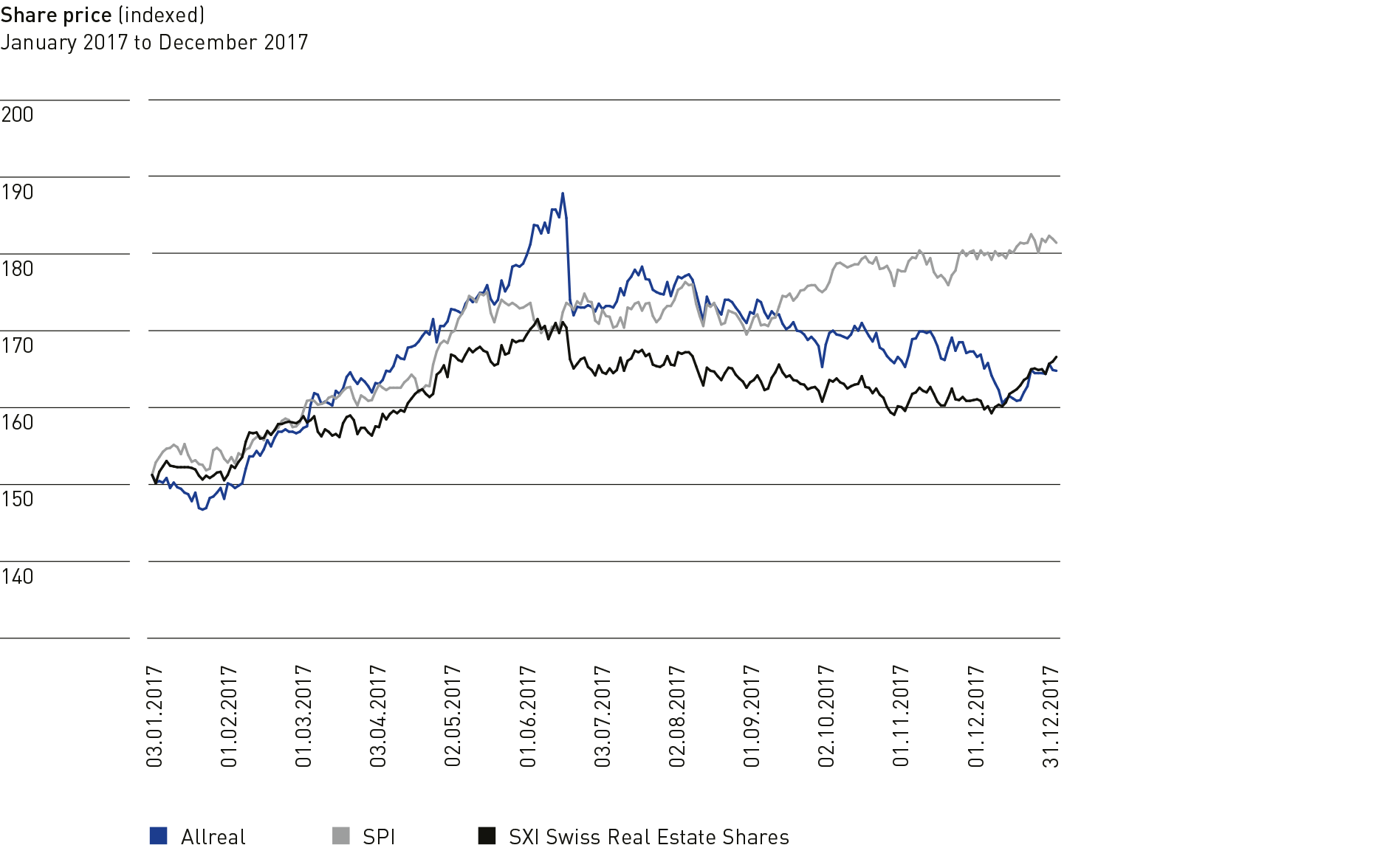

In 2017, an overall performance of 12.7% was achieved with the Allreal share, based on the market price of 31 December 2017. This performance comprises the increase in share price (8.9%) and the distribution to shareholders (3.8%).

In the past three years, investors obtained an annualised overall performance of 1.5% (2015), 17.5% (2016) and 12.7% (2017) with the Allreal share, corresponding to an average constant return of 11.5% p.a.

On 31 December 2017, the Allreal Group’s market capitalisation stood at CHF 2,622.5 million. As at the balance sheet date, consolidated equity came to CHF 2,150.7 million, resulting in a premium (difference between the market price and equity per share) of 21.9% (31.12.2016: 15.5%).

The Board of Directors will propose to the annual general meeting of 20 April 2018 an unchanged distribution of CHF 6.25 per registered share in the form of a nominal value reduction.

The distribution amounts to 98.7% of the Real Estate division’s operating net profit excluding profit from revaluation effect, corresponding to a cash yield of 3.8%, based on the closing price of the registered share on 31 December 2017.